Donations

Help change the world.

Donate today to support CELDF’s cause of drving a new paradigm of equity and nature-centeredness.

Celebrating 30 Years!

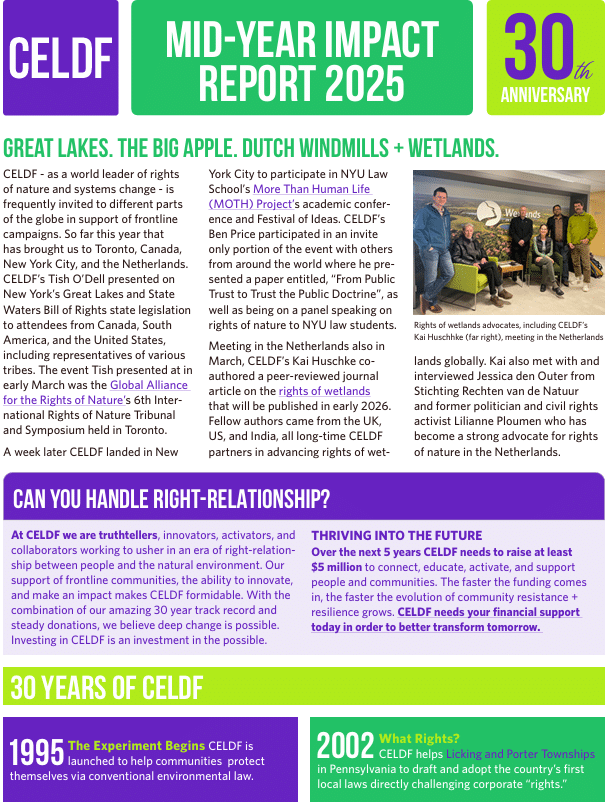

2025 Mid-year Report:

Learn. Share. Give.

Rights of nature makes it to the capital in New York. Rolling Stone features CELDF, yet again. Wetland rights advocates meet in the Netherlands. CELDF.org gets a whole new look. CELDF’s Can You Handle the Truth? is hot off the presses. Community resistance and resilience becomes the rally cry for transformative change. These are some of the major happenings for the first half of 2025 along with spotlighting major CELDF milestones over the last 30 years all covered in CELDF’s 2025 Mid-Year Impact Report.

$5 million over 5 years – CELDF’s ability to keep innovating, disrupting, and supporting community level action in the name of right-relationship will come from individuals who invest in CELDF so that we can help shape the future. Expanding our community resistance + resilience capabilities, offering more educational tools, and developing our readiness to help guide individuals, organizations, and governments comes by way of CELDF investing in these primary areas of the organization.

Your donations are what makes this all happen and we need you to contribute towards the goal of $5 million over the next 5 years. Please make a donation today.

CELDF’s 2025 Mid-Year Impact Report Get Caught Up. Spread the Word. Give Generously. Celebrate CELDF’s 30th Anniversary!

$20M+

for community support.

From day one, CELDF has been offering education, organizing, and legal expertise at little to no cost, providing communities and others with over $20 million in support. We have been empowered to offer these pro bono or low-cost services thanks to grants, gifts, and the ongoing donations of generous people like you.

However, we anticipate that as CELDF becomes more effective at challenging the unjust, corporate-controlled elements of the system and helping to drive a new paradigm of equity and nature-centeredness, foundation moneys will be more and more difficult to acquire, due to their close link with corporate activity. That’s why it’s all the more crucial that generous donors continue to support our outside-the-box organization. Our track record and our current capability more than prove that donating to CELDF will make a positive impact.

Please donate today.

CELDF appreciates your support, so we try to make it easy to donate with a wide variety of options to suit your preferences. You can make one-time or recurring payments with ACH, credit card,

or PayPal.

Prefer to mail a check?

CELDF

PO Box 360

Mercersburg, PA 17236

Please include your full name and address with the check.

Spread the CELDF love!

If you’re retirement age, you can donate up to $105,000 per tax year directly from an Individual Retirement Account (IRA) to charities like CELDF. Qualified Charitable Distributions (QCD), otherwise known as IRA charitable rollovers or IRA gifts, may be excluded from your taxable income and qualify towards your required minimum distribution (RMD) if you don’t want or need the funds.

QCD rules:

- You must be 70 ½ or older at the time of gifting your IRA to charity.

- You may distribute up to $105,000 in a calendar year to one or more public charities, so long as the distribution is completed by December 31 of that year.

- Your IRA administrator must make the distribution directly to the charity, or

- you may write a check to the charity from your IRA checkbook.

Funds withdrawn by you and then contributed do not qualify.

QCD restrictions:

Per IRS regulations, QCDs cannot be made to a donor advised fund (DAF). A QCD can be made to your sponsoring 501(c)(3) organization if there are programs that you can fund outside of your DAF. Such purposes include general support for the charity or for other programs they may maintain outside of their role as a DAF sponsor. For additional information on QCDs and DAFs, please contact your charitable sponsor.

Making a QCD/IRA charitable distribution to CELDF:

- Contact your IRA administrator and instruct that person to transfer funds to CELDF. Your financial institution should make the check out to “CELDF” and identify you as the donor by name and address.

- Ask your IRA administrator to include your full name and mailing address on the gift.

- Ask your administrator to note that the transfer is an IRA Qualified Charitable Distribution. We do not encourage restricted gifts.

Have more questions?

Common types of planned gifts:

- Bequests: Donate cash and/or securities through your will, now or later, by naming CELDF as your beneficiary.

- Beneficiary Designations: Donate life insurance and retirement plan gifts (IRAs and 401Ks) to CELDF as the beneficiary. Please talk to your attorney or financial planner to determine what works best for you and your family.

Naming CELDF in your will:

Legal name: Community Environmental Legal Defense Fund (CELDF)

Address: PO Box 360, 10914 Clay Lick Road, Mercersburg, PA 17236

Federal tax ID#: 25-1760934

Notification: Let us know when you have named CELDF in your will or trust so that we can thank you and include you in our Legacy Society.

Sample language for your will:

“I give and bequeath to the Community Environmental Legal Defense Fund (CELDF), PO Box 360, 10914 Clay Lick Road, Mercersburg, PA 17236 [the sum of __________ Dollars ($____)] [ _______ % of the rest, residue and remainder of my estate], to be used for its general charitable purposes.”

Have more questions?

Support CELDF Today.

If you would like to give anonymously, please email info@celdf.org with “Anonymous Donation” in the subject line.